Specializing in Reducing College Costs Before and After Graduation

Maximize the free money & lower the sticker price

There are over 3,000 colleges and universities in the United States. We walk your child through the process of determining which will be the best “fit” for them academically, socially and financially.

The colleges your student chooses heavily influences the net cost for your family.

College is expensive, no matter what school you attend. The cost can range from $40,000 to $250,000.

Maximizing the free money is critical to reducing your college costs.

Reduce the loans and loan payments

So much focus is on finding scholarships. However, what about after the kids graduate? There is still a lot you can do to reduce the cost of college by reducing the college loans.

There are several ways to reduce the college loans, and the biggest savings could come through income driven repayment plans.

Get a full college funding refund in retirement

The problem with using traditional college savings accounts and whole life insurance, or your retirement account, is that you interrupt the compounding interest.

This is the single biggest expense when paying for college...the opportunity cost.

How you pay for college is 10x more important that how much you pay.

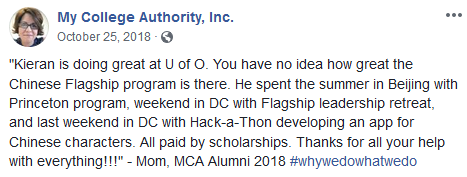

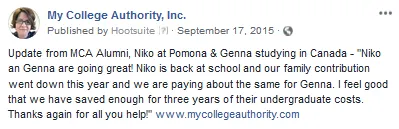

What People Are Saying

"The 'wild hair' Cori suggested turned out to be a winner!

My son will be attending the University of Idaho. He gets to study chemistry, and will compete in cross country & track. It looks like it will be a good fit for him. He is going to apply for the honors program as was suggested by the chair of the chemistry department.

All thanks to Cori's suggestion."

— LINDA D.

"Today, our daughter is a college senior with no debt!"

— BRIAN & RENE S.

"Money can be stressful to talk about. And there is a steep learning curve throughout the college process. I know it helped having a third-party walk through the process.

I feel like we have done everything we can to get our daughter into one of her top choices and be able to afford it."

— JULIE M.

"A dream come true... got a text from my daughter that said, 'Thanks for sending me to this school!'"

— LESLIE G.

"The RELIEF and help Cori is providing is a blessing to our family.

The BEST GIFT we can hope to provide our children is their EDUCATION."

— NATALIE

"I'm feeling relieved after our conversation with Cori yesterday.

We're thankful for her patience as we wrapped our brains around this process. We're grateful for her expertise and willingness to be our guide."

— Christy H.

"I just wanted to share the good news with you.

In the past few weeks, my son has received 3 scholarships!

We couldn't have done this without your help."

— David P.

"I had few questions about what some of the FAFSA questions were asking. Cori was so helpful with her counsel on what to do and what not to do."

— JENNIFER S.

Copyright © 2025. Cori Grabenstein-Murphy, LLC All Rights Reserved

Privacy Policy